Thank you to Compass Chief Market Analyst, Patick Carlisle for the market data and insights for this blog post.

Fair market value is that price a qualified, reasonably knowledgeable buyer is willing to pay, which a seller, not under duress, is willing to accept after the home has been properly exposed to the market.

Fair market value is that price a qualified, reasonably knowledgeable buyer is willing to pay, which a seller, not under duress, is willing to accept after the home has been properly exposed to the market.

Neither agents nor sellers determine market value: Only the market willing and able buyers determines market value. Agent and seller work together to create a plan which includes pricing, preparation and marketing to maximize the conditions that reliably achieve the highest possible sales price.

The vast majority of buyers will not make offers on homes they consider significantly overpriced. Either they don’t want to waste their time, or are uncomfortable with possibly “offending” the seller. In any case, they simply move on to other listings.

Well-priced homes create a sense of urgency in the buyer/broker communities to act quickly with strong, clean offers, and often lead to competitive bidding between buyers which is the most likely way to increase sales price.

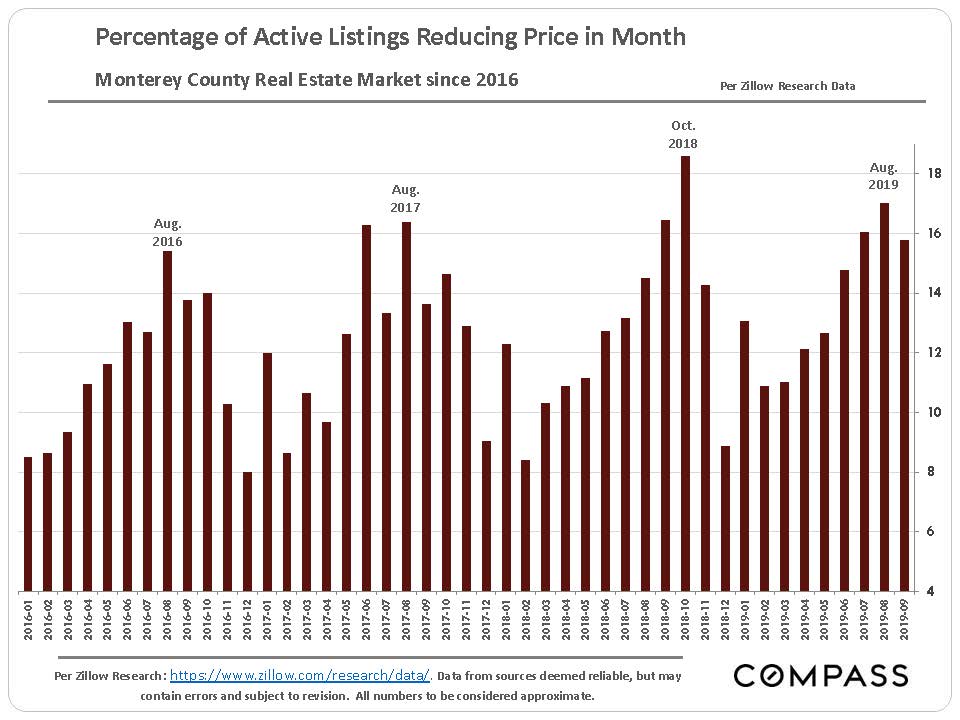

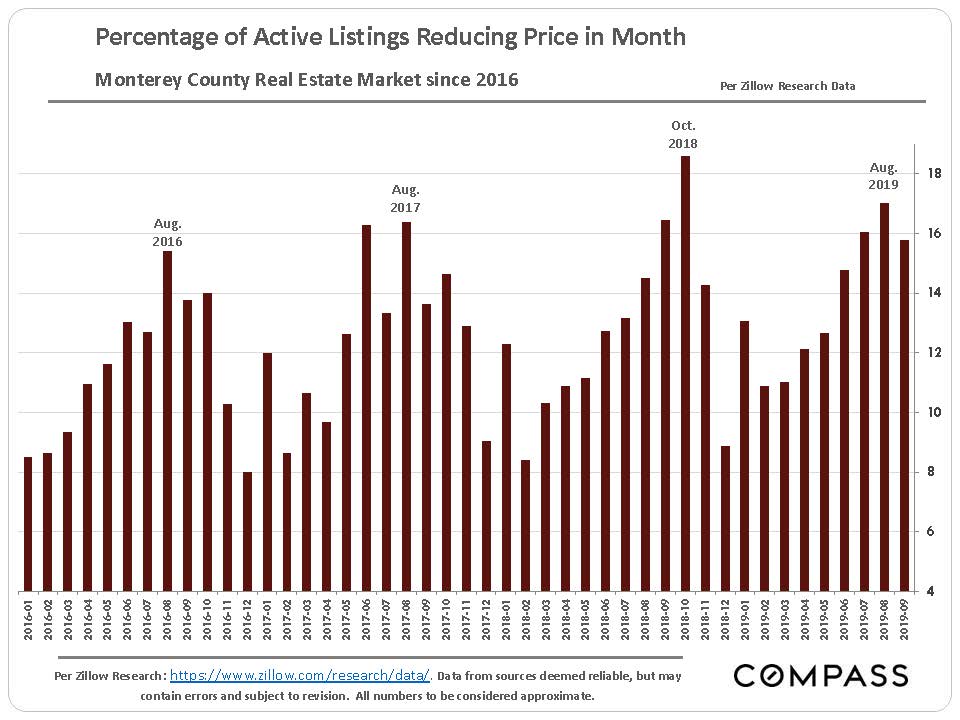

Overpricing wastes the optimum moment of buyer and broker attention: when it first comes on the market. This moment cannot be recaptured.

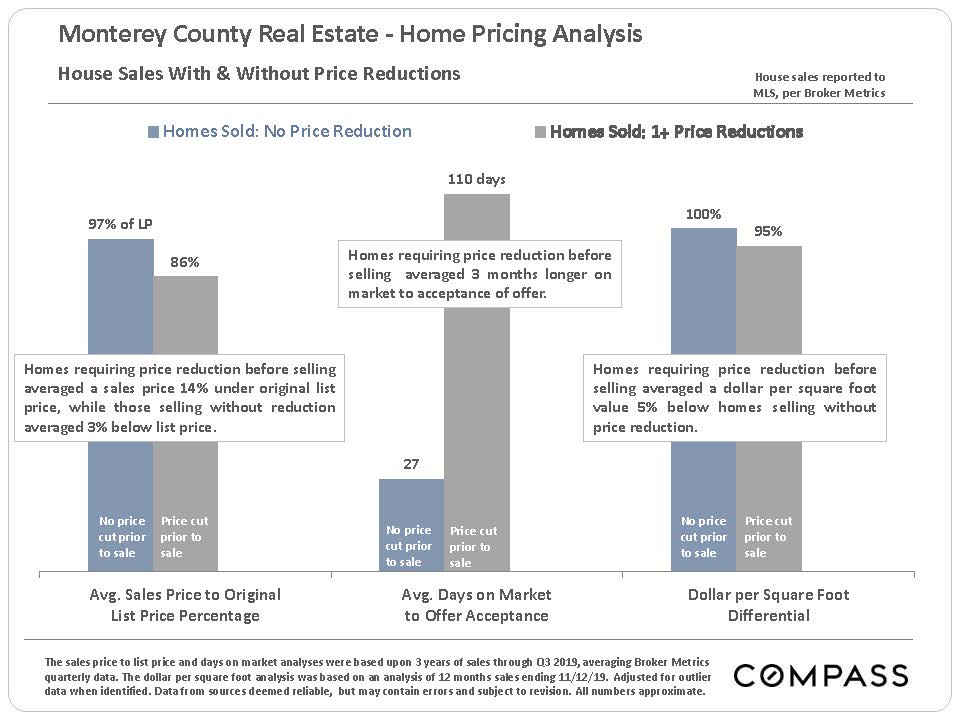

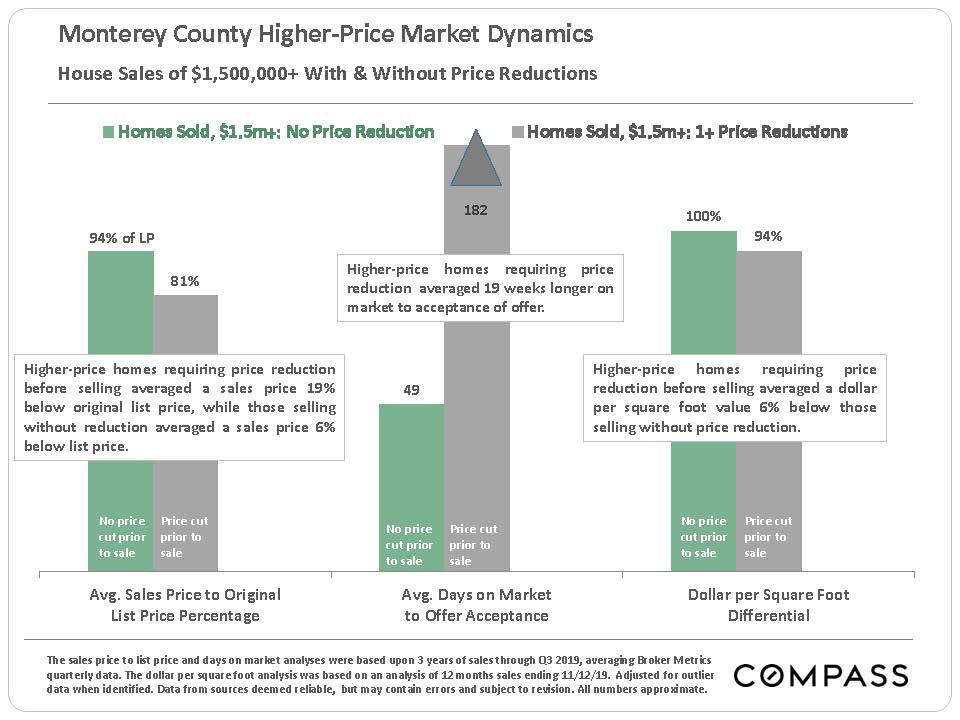

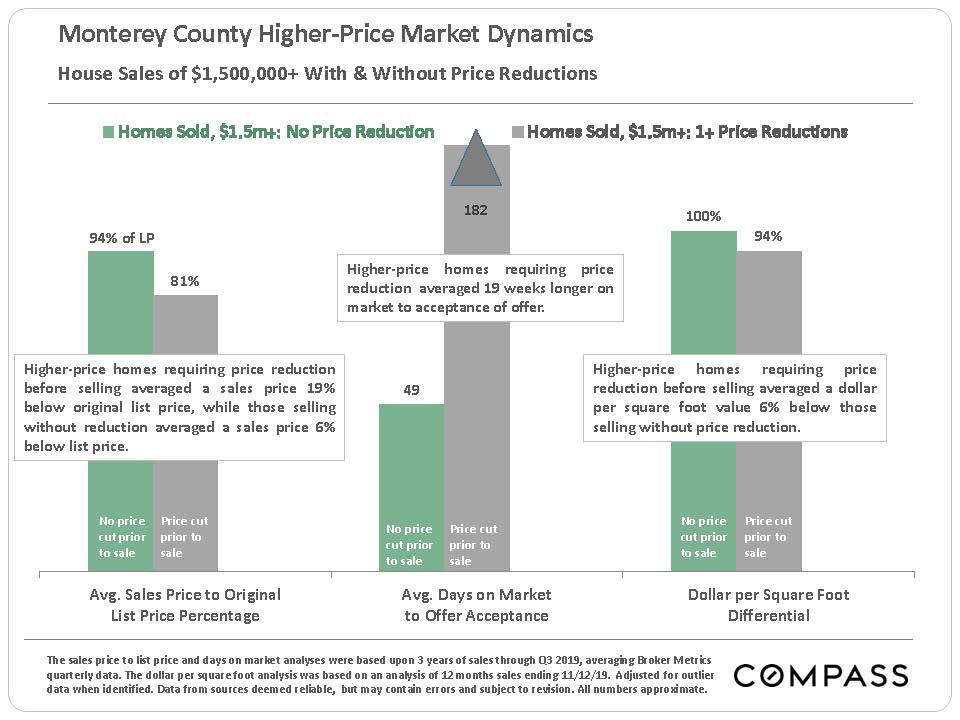

Overpriced homes kill any sense of buyer urgency and take much longer to sell, which then significantly reduces value in buyers’ minds: “There must be something wrong with it if it hasn’t sold by now.” It almost always eliminates the possibility of competitive bidding.

Overpricing helps sell competitive properties, since they stand out as good values in comparison.

If a listing has inadvertently been overpriced , the sooner it is recognized as such and the price reduced, the smaller the negative impact. Price reductions must be big enough to regain the attention of buyers and their agents typically, at least 5%.

In order to win the listing, some agents suggest a list price considerably higher than what they believe market conditions and comparable sales justify because they believe this is what the seller wants to hear. This is called “buying the listing” and is a violation of the fiduciary duty of honesty that an agent owes their client.

- Price it right to begin with.

- Prepare the home to show in its best possible light.

- Implement the most comprehensive marketing plan possible.

- Hire an agent who knows how to negotiate effectively on your behalf, and manage the disclosure and due diligence processes.

The difference can add up to tens or even hundreds of thousands of dollars.